As markets bet on deeper interest-rate cuts, Americans could see borrowing costs fall more than expected this year.

Chicago Fed President Austan Goolsbee, pointing to fresh inflationdata, said there is potential for more interest-rate cuts this year, but only if inflation continues to dip toward the central bank’s 2% target.

Traders priced in higher odds that the Fed will cut interest rates more than twice this year after the January Consumer Price Index rose less than expected last month.

The dip may have addressed concerns of some Fed policymakers that inflation may be too high to cut interest rates more than once this year, especially after the hot January jobs report was much stronger than expected.

Goolsbee told CNBC Feb. 17 that the CPI data showed that services inflation remains elevated.

But Goolsbee said if price hikes linked to tariffs are a one-off, the Federal Open Market Committee could lower rates more than the single cut policymakers had forecast in December.

TheStreet/Federal Reserve Bank of New York

CPI figures reflect inflation dip

The Bureau of Labor Statistics reported Feb. 13 that the CPI 0.2% rise in January was the smallest gain since July, reflecting lower energy costs.

- Overall inflation unexpectedly dropped to 2.4% in January from the same time last year. That was down from the previous 2.7% annual pace.

- Core inflation, which filters out volatile food and energy prices, ticked down to 2.5% on a year-over-year basis. It last stood at 2.6%.

Americans did see some relief on the costs of everyday purchases as electricity prices ebbed and gasoline prices dropped by the most in nearly a year.

Grocery prices rose the least since July.

“On balance, we found today’s report to be encouraging,” Wells Fargo & Co. economists said in a note reported by Bloomberg. “Tariff-induced price hikes probably have not fully worked their way through the data, but we are closer to the end than the beginning of this source of higher prices.”

According to January’s CPI, shelter rose 0.2% and was the largest factor in the all-items monthly increase.

- The food index increased 0.2%, as did the food at home index.

- The food away from home index rose 0.1%.

- These increases were partially offset by the index for energy, which fell 1.5%.

January jobs report showed resilience

- The Fed is cautious about cutting rates too quickly, concerned it may send the wrong signal about its commitment to the 2% target. Simultaneously, policymakers don’t want to damage the labor market, which showed significant signs of cooling late last year.

- The January jobs report on Feb. 11 delivered a sharp upside surprise, complicating expectations for Fed interest-rate cuts and reinforcing the view that the U.S. labor market remains more resilient than policymakers anticipated.

- Payrolls rose by the most in more than a year to 130,000, beating estimates of 55,000.

- Theunemployment rate unexpectedly fell to 4.3% from 4.4%.

FOMC January meeting holds rates steady

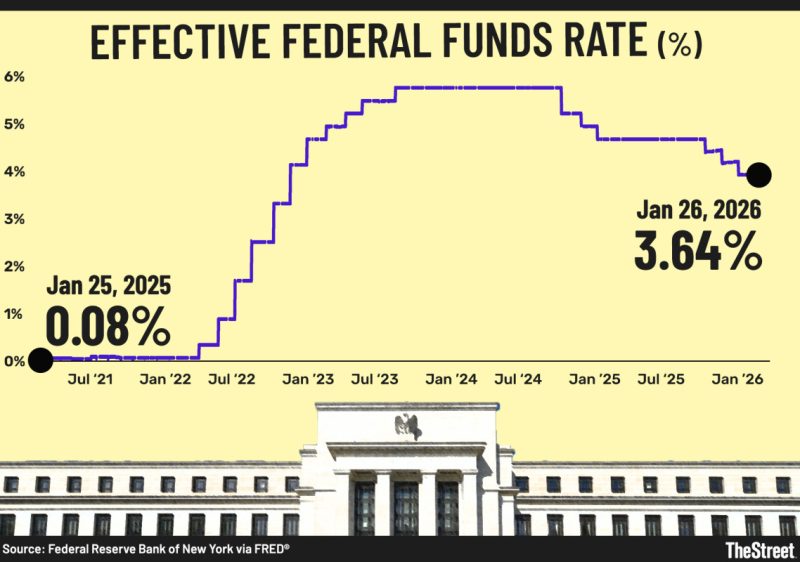

The FOMC voted 10-2 to hold interest rates steady at 3.50% to 3.75% in January on the benchmark Federal Funds Rate after three consecutive quarter-point cuts in its last three meetings of 2025.

The Federal Funds Rate guides interest rates for investors and consumers on auto and student loans, home-equity loans, and credit cards.

More Federal Reserve:

Fed Chair Powell sends frustrating message on future interest-rate cuts

For consumers, a delayed rate cut could mean higher borrowing costs that remain in place longer than expected.

Fed Governors Stephen Miran and Christopher Waller dissented, saying they would have preferred a quarter-point cut due to softening in the labor market.

It was the FOMC’s first pause since July 2025.

How the Fed manages interest rates

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines, and are influenced by unpredictable global events.

Related: Traders pivot Fed rate cut bets after CPI surprise

After the December rate cut, Fed Chair Jerome Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.”

A neutral rate neither stimulates nor restrains economic growth.

When the Fed last paused interest rates

The Fed last paused interest rates in September 2023, holding the funds rate at 5.25% to 5.50% after a rapid tightening cycle aimed at curbing post-pandemic inflation.

The pause lasted nearly a year as policymakers wanted to see if the higher borrowing costs would tame inflation without dipping the economy into a recession.

During that pause, inflation gradually cooled and the labor market remained resilient.

The central bank resumed cutting rates in September 2025 once Fed officials became confident that inflation was moving sustainably toward the Fed’s 2% target.

Goolsbee ties inflation to future interest-rate cuts

“Easing inflation and limited supply ahead will extend the constructive tone in Treasuries,” Alyce Andres of Bloomberg Strategists said after the CPI data were released. “The soft CPI reading is supporting the front-end and reinvigorating a Goldilocks scenario for bonds right now, even if inflation shows up later this year.”

Goolsbee is not a voting member of the Federal Open Market Committee this year. The 12-member board is made up of the seven Fed governors and regional bank presidents.

Goolsbee said he wants to see more information on the lower inflation trends over six to eight months of data.

“I do think that if this proves to be transitory, and we can show that we’re on path back to 2% inflation, I still think there’s several more rate cuts that can happen in 2026, but we’ve got to see it,” Goolsbee said.

He added that “so far, we’ve basically been stalled out at 3%.”

“I want some evidence that we’re headed back to 2%, and then I think rates can keep coming down,” Goolsbee said.

When will the next interest-rate cut take place?

There is still a month of economic data, including the February jobs and CPI reports, to be released before the March FOMC meeting.

The Fed’s preferred inflation gauge — Consumption Expenditures Price Index (PCE) — will be released Feb. 20.

The CME Group FedWatch tool reports the likelihood of a quarter-point cut in the upcoming 2026 FOMC meetings as follows.

- March 18: 7.8%

- April 29: 23.6%

- June 17: 51.1%

- July 29: 44.8%

- Sept. 16: 37.1%

- Oct. 28: 35.4%

- Dec. 9: 31.7%

Related: Federal Reserve official blasts latest interest-rate pause