Look at the news and you will find story after story about artificial intelligence, or AI. It seems likely to change the world and, predictably, Wall Street is a big part of the AI push. That includes finance companies giving investors ways to put money in the space, like the Global X Robotics & Artificial Intelligence ETF (BOTZ 0.57%).

Should you jump aboard on the hope of AI making you a millionaire? Here are some things to think about first.

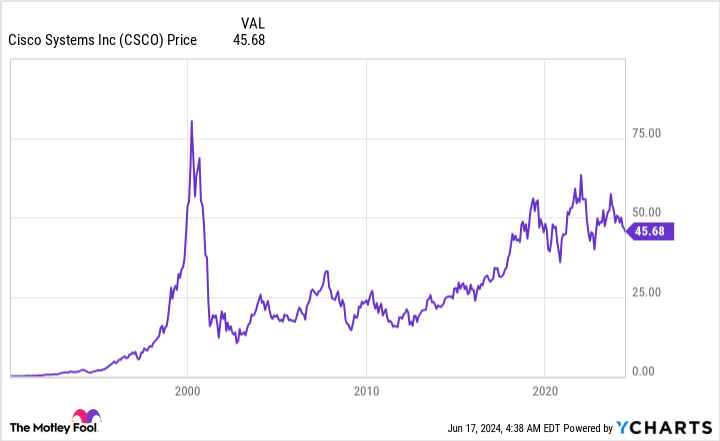

Cisco Systems: An important cautionary tale

It may seem like ancient history today, but back in the late 1990s, there was a new technology that was expected to revolutionize the world. It was called the internet. The internet did, in fact, change the world, but there were a lot of companies in the mix that didn’t do much of anything. And even some of the big names that have stuck around haven’t turned out to be good investments.

What went wrong? The answer is that Wall Street hype doesn’t always translate into investment success. Emotions often push investors to buy things blindly and aggressively in the hope of becoming millionaires. That leads to investment bubbles that eventually burst. As the turn of the century approached and the internet was new it was called the “dot-com bubble,” and it burst in the early 2000s.

Cisco Systems (CSCO 0.61%) was one of the hot stocks when the bubble was building up, as you can see from the chart below. And when the bubble burst investors lost a lot of money. The stock still isn’t back to where it was during its heyday more than two decades ago.

CSCO data by YCharts

Punt with the Global X Robotics & Artificial Intelligence ETF

This example should be a big warning for investors who are chasing after current market darling Nvidia (NVDA 3.51%). Sure, it could make you a millionaire, but if the AI bubble bursts like so many other bubbles have in the past you could end up holding the bag like many investors did with Cisco. A far better option would be to take a broad-based approach via an exchange traded fund (ETF) like the Global X Robotics & Artificial Intelligence ETF. Nvidia is the top holding (roughly 13% of assets), but it isn’t the only holding in this diversified ETF.

In fact, there are another 40 or so stocks in the Global X Robotics & Artificial Intelligence ETF, all of which have notable exposure to the AI and robotics theme. And the portfolio is rebalanced on a regular basis, taking profits from the big winners and allocating that cash to other stocks in the portfolio. So while Nvidia is doing exceptionally well today, pushing its weighting past the ETF’s 8% high-end weighting target, it will be brought back into line eventually. That helps to reduce the risk that any one stock will be overly important to performance.

CSCO data by YCharts

This is a big ETF, with $2.7 billion in assets. That said, the management fee is a bit high at 0.68%, which, if you want to be cynical, is a function of the sponsor being able to take advantage of the popularity of the AI theme. Though, to be fair, it probably does require some extra effort to identify AI companies for the portfolio. But the key here is to keep the popularity of AI in mind as you invest. You are chasing a hot investment theme and eventually hot themes end. That’s why it is a good idea to invest in a diversified way with an ETF like the Global X Robotics & Artificial Intelligence ETF. But it might also be a good reason to only put a small percentage of your net worth into the ETF.

Tread carefully with thematic ETFs like Global X Robotics & Artificial Intelligence ETF

Could this ETF help you build a seven-figure portfolio? It could. But the risk/reward balance here is tilted heavily toward risk given the fact that Wall Street expects AI to change the world and make investors rich along the way. Even if the technology does change everything, there’s no guarantee that it will make investors money now that Wall Street has bid the shares of AI stocks like Nvidia to huge heights. It is probably best to think of this fund as a part of a larger diversified portfolio that can, hopefully, help you become a millionaire over time, not overnight.