Energy stocks were an afterthought for most of 2025 as investors focused on red-hot big tech stocks benefiting from AI spending. However, a quiet shift began last fall, and the group has steadily climbed the proprietary sector ranking I built over 20 years ago into the top spot.

Oil stocks have delivered especially robust returns that likely make tech investors jealous, with gains largely built on rising optimism about production growth rather than on hopes for soaring crude oil prices.

The removal of Nicolas Maduro opens up Venezuela’s303 billion in proven reserves to development. Meanwhile, West Texas Intermediate trades in the low $60s per barrel, down from $76 last June.

Venezuela’s oil reset is potentially the biggest production growth opportunity since fracking reshaped the Permian.

The optimism is palpable. The Energy Select SPDR ETF (XLE) and SPDR Oil & Gas ETF (XES) are up 23% and 51% since September, respectively.

The rally isn’t showing signs of slowing, and with energy stocks breaking out to new highs and the group significantly underweight in the S&P 500, the tailwinds are strong.

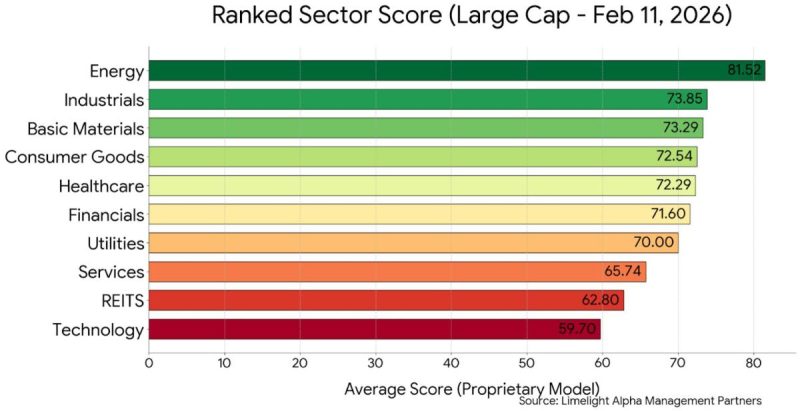

Energy is highest-scoring S&P 500 sector

I developed my sector ranking in 2003 for mutual and hedge fund managers. It has influenced portfolio managers’ and analysts’ opinions for over 20 years, and Limelight Alpha continues to produce it weekly.

The latest data show that energy is the best-scoring basket under the multifactor model, which blends fundamental and technical factors, including earnings, valuation, and momentum.

Limelight Alpha

Energy’s strength suggests investors are warming up to the idea that portfolios have become too tilted toward technology, which accounts for roughly 35% of the S&P 500, and away from energy, which accounts for just 3% of the index now.

For perspective, energy stocks represented over 10% of the S&P 500 10 years ago.

The sector’s rise largely rests on oil stocks, particularly energy service companies likeSLB (SLB) (formerly Schlumberger), Baker Hughes (BKR), and Halliburton (HAL).

Those companies sit at the center of what could eventually total up to $100 billion in infrastructure spending to refurbish Venezuela’s oil fields.

During earnings calls, the CEOs of all three companies struck a positive tone about how quickly they could deploy assets in Venezuela if oil majors ramp up activity there.

SLB CEO Olivier Le Peuch said Venezuela was once a $1 billion business for his company, while Halliburton said it once generated half a billion in annual revenue there.

The potential for an acceleration in revenue, and a corresponding lift to earnings, is likely a major reason for the pivot higher, and a big catalyst for why energy equipment and services is among the strongest scoring industries in our industry ranking, alongside midstream (pipelines, storage terminals, and processing plants), and exploration & production stocks like Chevron (CVX), ExxonMobil (XOM), and ConocoPhillips (COP).

Venezuela is a wildcard, but that may be a good thing

There are plenty of reasons to question whether the White House will succeed in its plans to tap Venezuela’s massive reserves.

So far, public comments from ExxonMobil and ConocoPhillips have poured cold water on their eagerness to go all-in on spending there.

More Oil and Gas:

- Energy giant sends blunt $20 billion message on dividend growth

- 147-year-old oil giant just raised dividend 4% in 2026

- Top energy stocks to buy amid Venezuela chaos

ExxonMobil’s CEO, Darren Woods, said in January that, under the current framework, Venezuela is “uninvestible.”

ConocoPhillips CEO Ryan Lance said they’re most focused on recouping the $10 billion they’re owed there from past seizures stemming from Venezuela’s nationalization of its oil industry under the PSDVA banner during Hugo Chavez’s reign.

Chevron, which is the only one of those three companies to accept a minority stake in Venezuela operations when Chavez offered it, is more optimistic, given it’s already there and pumping black gold.

Chevron’s Venezuela projects:

- Petroboscán: A 39.2% interest in the Boscan Field.

- Petroindependiente, S.A.: 25.2% interest in the LL-652 Field at Lake Maracaibo

- Petropiar, S.A.: 30% interest in Huyapari Field within heavy-crude dominant Orinoco Belt.

- Petroindependencia, S.A.: 34% interest in Carabobo 3 Project in Carabobo area of the Orinoco Belt (extra-heavy crude).

- Ioran: 60% interest offshore in the Loran Field.

Source: Chevron.

Chevron’s C-suite suggested they could accelerate Venezuela production by 50% relatively quickly. Chevron was producing about 200,000 barrels per day there before restrictions more than halved that amount over the past two years.

The mixed messages provide enough doubt to keep some investors at bay. That’s not a bad thing, because, as we witnessed with artificial intelligence over the past few years, doubters keep money on the sidelines that can fuel future rallies on pullbacks to support levels, such as the 50-day moving average.

It’s when everyone agrees and is all-in on a trade’s direction that it’s most at risk of faltering.

How investors should approach energy stocks

The basket is underweight in most portfolios and somewhat reminds me of gold two years ago.

Investors interested in owning energy stocks should concentrate on the major ETFs for broad exposure, while aggressive investors can consider individual companies, including energy service stocks likely to win contracts in the coming months.

Related: Top energy stocks to buy amid Venezuela chaos

Personally, I’ve added energy services (XES) to my portfolio, as well as a select basket of energy stocks, including Transocean (RIG), an offshore driller; Baker Hughes (BKR), an energy services giant; and Core Labs (CLB), which helps companies maximize oil and gas fields.

So far, my exposure to the basket is relatively small and mirrors the S&P 500 weighting. However, I plan to add more positions in other stocks, including SLB and Halliburton, and to add to my starter positions in those other stocks on weakness.

These stocks are likely to provide plenty of opportunities to trade down to support levels, and during my career, I’ve learned that it pays to build positions over time to smooth out risk.

Todd Campbell owns shares in XES, SLB, HAL, CLB, and RIG.

Related: ConocoPhillips CEO sends strong message on Venezuela oil future